UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. ___)______)

Filed by the Registrant | ☒ | |

Filed by a party other than the Registrant | ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Under Section 240.14a-12 |

BM Technologies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply): | ||

☒ | No fee required. | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i) |

BM Technologies, Inc.

201 King of Prussia Road, Suite 350650

Wayne, PA 19087

May2, 2022April 29, 2024

Dear Stockholder:

You are cordially invited to participate in BM Technologies, Inc.’s 20222024 Annual Meeting of Stockholders to be held virtually on June15, 2022 20, 2024 at 10:00 a.m. Eastern Time, at the following website: https://www.cstproxy.com/bmtechnologies/2022/2024.

The Notice of Annual Meeting and proxy statement accompanying this letter provide an outline of the business to be conducted at the meeting. I will also report on the progress of the Company during the past year and answer stockholders’ questions.

It is important that your shares be represented at the Annual Meeting. If you are unable to participate in the meeting, Iwe urge you to vote your shares by telephone or over the internet or by completing, signing, dating, and returning your proxy card or voting instruction form so that your shares will be represented at the Annual Meeting. Instructions for voting are described in the Notice, the Proxy Statement, and the proxy card. We urge you to complete, sign, date, and return your proxy card or authorize your proxy by telephone or through the internet as soon as possible even if you currently plan to participate in the Annual Meeting. This will not prevent you from voting virtually but will assureensure that your vote is counted if you are unable to participate in the meeting.

In 2023 we committed to a profit enhancement plan that reduced 2023 core operating expenses by approximately $9.5 million. The Company consistently had quarterToday, BMTX is one-over-quarter improved EBITDA. Additionally, in December, the Company completed the transfer of the largest digital banking platformsHigher Education customer deposits to our new partner bank, First Carolina Bank (“FCB”). The transfer is expected to increase the Company’s annualized interchange revenue. The Company serviced deposits have slightly decreased from 2022 to approximately $0.8 billion, although debit account spend has remained consistent at $3 billion.

Going into 2024, we believe we are better positioned for growth and banking-as-a-service providersprofitability this year and over the long term. We expect further savings from the profit enhancement plan that began in 2023 and higher revenues from our switch to our new partner bank, FCB. Additionally, we have made significant investments to upgrade our technology platform, positioning us to deepen customer relationships, increase customer lifetime value and unlock new revenue streams. Most importantly, we have enhanced our leadership team by appointing Ajay Asija as Chief Financial Officer. Mr. Asija has over 25 years of experience as a financial professional, with a significant focus in the country. financial technology (“FinTech”) industry. The Company will leverage his extensive FinTech and banking network for partnership opportunities to drive growth and to ensure best practices for our finance and accounting teams.

We are onbelieve that our solid foundation for growth distinguishes us from other FinTech companies. With an established base of customers, deposits, partnerships, and a mission to financially empower millions of Americans by providing a more affordable, transparent,robust and consumer friendly banking experience. We were one of the first neo banking fintechs to go public last year, are one of the first to have a profitableflexible technology platform, our leadership team remains excited about our growth opportunities for both our existing business model and are now among the first fintechs embracing a bank charter to create an innovative fintech bank with a sustainable, profitable business model into the future. We continue to execute on our mission of providing millions of Americans with a better banking experience and are working to create significant shareholder value over the next 3-5 years by executing on our strategy.new opportunities!

On behalf of your Board of Directors, thankThank you for your continued interestinvestment in and support.ongoing support of our Company. We appreciate your confidence and will continue to work to build long-term shareholder value while remaining committed to innovation, building great products, and serving our customers and team members at the highest levels.

Sincerely yours, | ||

| ||

Luvleen Sidhu | ||

Founder, Chief Executive Officer and Chair |

TABLE OF CONTENTSTable of Contents

Page | ||

ii | ||

1 | ||

2 | ||

3 | ||

6 | ||

8 | ||

| ||

19 | ||

| ||

| ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| |

| ||

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| |

|

i

BM TECHNOLOGIES, INC.

201 King of Prussia Road, Suite 350650

Wayne, PA 19087

NOTICE OF VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 1520, 2024 AT 10:00 A.M. ET, 2022

Online Meeting Only — No Physical Meeting Location

https://www.cstproxy.com/bmtechnologies/20222024

To the Stockholders of BM Technologies, Inc.:

The 20222024 Annual Meeting of Stockholders of BM Technologies, Inc. (the “Company”) will be conducted virtually on June 15, 2022,20, 2024, at 10:00 a.m. (Eastern Time), at the following website:

https://www.cstproxy.com/bmtechnologies/20222024, for the following purposes:

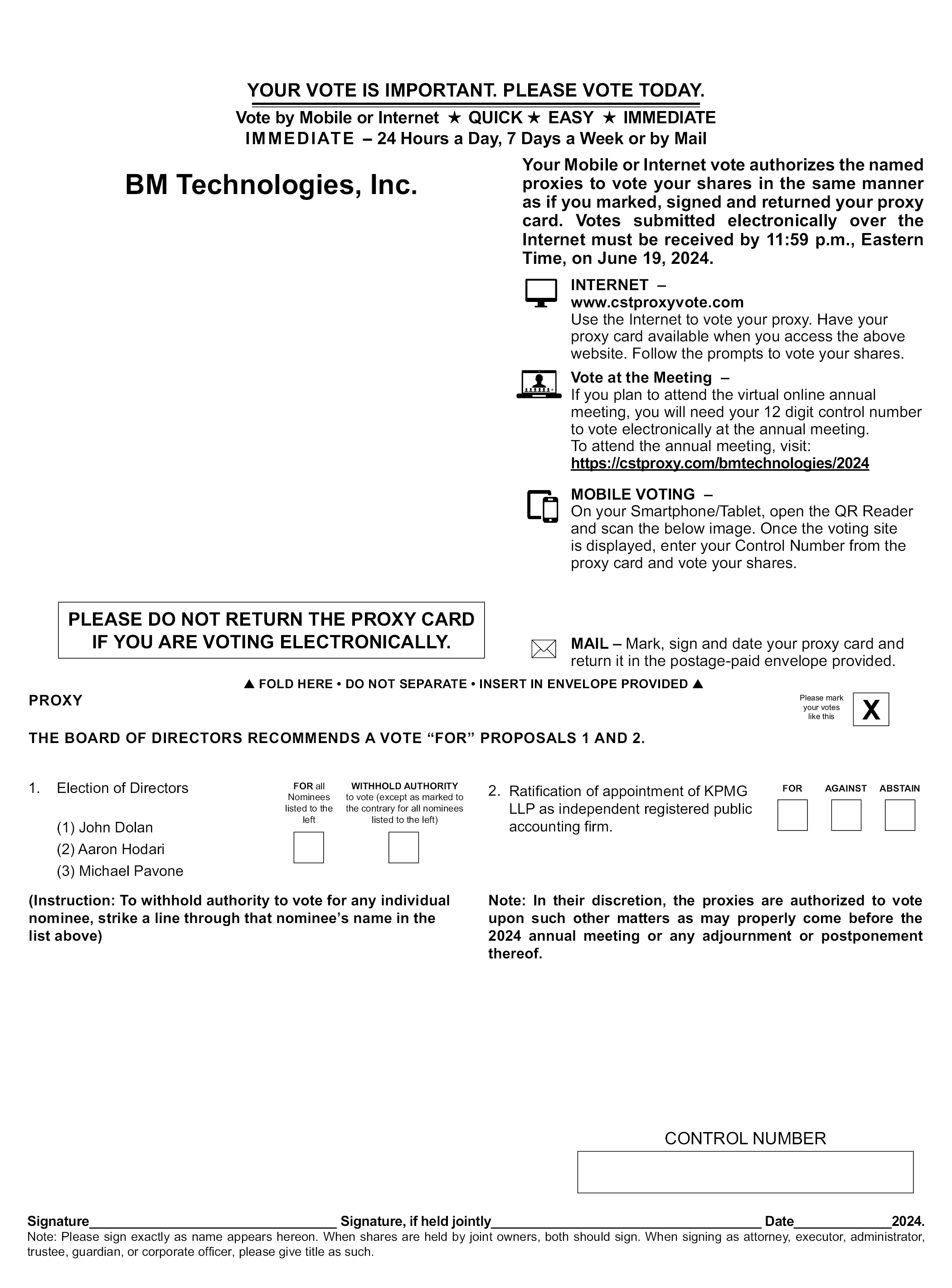

1. To elect, threeas described in the proxy statement, two Class I directors nominated for a term to expire at the 2027 Annual Meeting and one Class II directorsdirector nominated for a term to serve until their respective successors have been duly elected and qualified expire at the 2025 Annual Meeting (Proposal No. 11));

2. To ratify the appointment of BDO USAKPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 2024 (Proposal No. 22)); and

3. To transact such other business as may properly come before the meeting, or any adjournments or postponements thereof.

This year, we are using the Internet as our primary means of furnishing proxy materials to stockholders. Accordingly, most stockholders will not receive printed copies of our proxy materials. We are instead mailing a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials and voting via the Internet (the “Notice”). This delivery method allows us to conserve natural resources and reduce the cost of delivery while also meeting our obligations to you, our stockholders, to provide information relevant to your continued investment in the Company. If you received the Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions in the Notice for requesting those materials. We encourage you to review the proxy materials and vote your shares.

You or your proxyholder can participate, vote, and examine our stockholder list at the virtual annual meeting by visiting https://www.cstproxy.com/bmtechnologies/20222024 and using the control number included on your proxy card or voting instruction form. You have the right to receive notice of and to vote at the meeting if you were a stockholder of record at the close of business on April 29, 2022.26, 2024. Whether or not you expect to participate in the virtual meeting, please vote by signing the enclosed proxy card and returning it promptly inor by authorizing your proxy through the self-addressed envelope provided.internet. If a broker or other nominee holds your shares in “street name,” your broker has enclosed a voting instruction form, which you should use to vote those shares. The voting instruction form indicates whether you have the option to vote those shares by telephone or by using the internet. In the event there are not sufficient votes for a quorum or to approve or ratify any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of the proxies by the Company.

By order of the Board of Directors, | ||

| ||

| ||

Chief Financial Officer | ||

Wayne, Pennsylvania

April 29, 2024

May 2, 2022

This is an important meeting. To ensure proper representation at the meeting, please indicate your vote as to the matters to be acted on at the meeting by following the instructions provided in Notice, the Proxy Statement, and the proxy card. Even if you vote your shares prior to the meeting, you still may participate in the meeting and vote your shares virtually.

ii

BM TECHNOLOGIES, INC.

201 King of Prussia Road, Suite 350650

Wayne, PA 19087

PROXY STATEMENT

20222024 Virtual Annual Meeting of Stockholders

To Be Held on June 15, 202220, 2024 at 10:00 a.m. ET

Online Meeting Only — No Physical Meeting Location

https://www.cstproxy.com/bmtechnologies/20222024

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of BM Technologies, Inc. (the “Company,” “BMTX”, “we,” “us” or “our”) for use at our 20222024 Annual Meeting of Stockholders to be conducted virtually via live webcast on June 15, 2022,20, 2024, at 10:00 a.m. (Eastern Time), and at any adjournments thereof (the “Annual Meeting”). You or your proxyholder can participate, vote, and examine our stockholder list at the virtual annual meeting by visiting https://www.cstproxy.com/bmtechnologies/20222024 and using the control number included on your proxy card or voting instruction form.

This Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 20212023 (the “Annual Report”) are available to stockholders at https://ir.bmtxinc.com. On or about May 6, 2022,April 29, 2024, we will begin mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on (a) how to access and review this Proxy Statement and the Annual Report via the Internet and (b) how to obtain printed copies of this Proxy Statement, the Annual Report and a proxy card. The Notice also explains how you may submit your proxy over the Internet. If you received a Notice and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting those materials included in the Notice.

We encourage you to vote your shares, either by voting virtually at the Annual Meeting or by granting a proxy (i.e., authorizing someone to vote your shares). If you vote by telephone or over the internet, or by completing, signing, dating, and returning your proxy card or voting instruction form, and we receive your vote in time for the meeting, the persons named as proxies will vote the shares registered directly in your name in the manner that you specified. If you give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR the election of the nominees as director and FOR the other matters listed in the accompanying Notice of Annual Meeting of Stockholders.

Your vote is important. Whether or not you plan to participate in the Annual Meeting, please promptly vote your shares by telephone or over the Internet, or by completing, signing, dating, and returning your proxy card or voting instruction form prior to the Annual Meeting so that your shares will be represented at the Annual Meeting. Instructions for voting are described in the Notice, the Proxy Statement and the proxy card.

Important notice regarding the availability of proxy materials for the annual stockholder meeting to be held on June 15, 2022:20, 2024:

The Notice of Annual Meeting, proxy statement, proxy card and our Annual Report for the fiscal year ended December 31, 20212023 are available at the following internet address: https://ir.bmtxinc.com.ir.bmtxinc.com.

1

When is the Annual Meeting?

The Annual Meeting will be conducted virtually on June 15, 2022,20, 2024, at 10:00 a.m. (Eastern Time).

Where will the Annual Meeting be held?

TheThere is no physical location for the Annual Meeting, which will be conducted virtually via live webcast at https://www.cstproxy.com/bmtechnologies/20222024.

What items will be voted on at the Annual Meeting?

There are two matters scheduled for a vote:

1. To elect threetwo Class I directors nominated for a term to expire at the 2027 Annual Meeting and one Class II directorsdirector nominated for a term to serve until their respective successors have been duly elected and qualifiedexpire at the 2025 Annual Meeting (Proposal No. 1); and

2. To ratify the appointment of BDO USAKPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20222024 (Proposal No. 2);.

In addition, stockholders will also consider and

3. To transact such other business as may properly come before the meeting, or any adjournments or postponements thereof.

As of the date of this proxy statement, we are not aware of any other matters that will be presented for consideration at the Annual Meeting.

What are the recommendations of the Board of Directors?

Our Board of Directors recommends that you vote:

“FOR” the election of the threetwo Class I director nominees and the one Class II director nomineesnominee named herein to serve on the Board of Directors; and

“FOR” the ratification of the appointment of BDO USAKPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.2024.

Will the Company’s directors be in attendance at the Annual Meeting?

The Company encourages, but does not require, its directors to attend annual meetings of stockholders. The Company expects all its directors to attend the Annual Meeting virtually. Last year, four of our directors at the time attended the meeting virtually.

Why did I receive a Notice of Internet Availability of Proxy Materials in the mail instead of a printed set of proxy materials?

Under rules adopted by the SEC, we are permitted to furnish our proxy materials over the Internet to our stockholders by delivering a Notice in the mail. Instead of mailing printed copies of the proxy materials to our stockholders, we are mailing the Notice to instruct stockholders on how to access and review the Proxy Statement and Annual Report over the Internet at https://ir.bmtxinc.comirbmtxinc.com. The Notice also instructs stockholders on how they may submit their proxy over the Internet or via phone. If you received a Notice and would like to receive a printed copy of our proxy materials, you should follow the instructions in the Notice for requesting these materials.

2

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on the record date, April 29, 2022,26, 2024, are entitled to receive notice of the Annual Meeting and to vote the shares for which they are stockholders of record on that date at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. As of the close of business on April 29, 2022,26, 2024, we had 12,273,43812,052,560 shares of common stock outstanding.

How do I vote?

With respect to Proposal No. 1, you may either vote “FOR” each of the Class I nominees and the Class II nomineesnominee to the Board of Directors, or you may vote “WITHHOLD AUTHORITY” for the nominees. For each of the other proposals to be voted on,Proposal No. 2, you may vote “FOR” or “AGAINST,” or abstain from voting altogether. The procedures for voting are fairly simple:

Stockholders of Record: Shares Registered in Your NameName. . If on April 29, 2022,26, 2024, your shares were registered directly in your name with the Company’s transfer agent, Continental Stock Transfer & Trust Company, then you are a stockholder of record. If you are a stockholder of record, you may vote virtually at the Annual Meeting or vote by giving us your proxy. You may give us your proxy submitting it over the internet or via phone or by completing, signing, dating, and returning your proxy card. Whether or not you plan to participate in the Annual Meeting, we urge you to give us your proxy by telephone or overthrough the Internet, or by completing, signing, dating, and returning your proxy card or voting instruction form, to ensure your vote is counted.You may still participate in the Annual Meeting and vote virtually if you have already voted by proxy or have otherwise given your proxy authorization.

• VIRTUALLY: To vote virtually, participate in the Annual Meeting, and submit your vote via the website.

• BYMAIL: If you received a proxy card by mail and choose to vote by mail, simply complete, sign and date the enclosed proxy card and return it promptly in the postage paid envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

Beneficial Owners: Shares Registered in the Name of a Broker or BankBank. . If on April 29, 2022,26, 2024, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by that organization. If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from the Company. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may be able to vote by telephone or over the internet as instructed by your broker or bank. To vote virtually at the Annual Meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy card.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock for which you are the stockholder of record as of April 29, 2022.26, 2024.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please provide a response for each proxy card you receive to ensure that all your shares are voted.

3

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted: “FOR” the election of the threetwo Class I director nominees and one Class II director nomineesnominee named herein to serve on the Board of Directors and “FOR” the ratification of the appointment of BDO USAKPMG LLP, as our independent registered public accounting firm for the fiscal year ending December 31, 2022.2024.

If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares as recommended by the Board of Directors or, if no recommendation is given, will vote your shares using his or her discretion.

Can I change my vote after submitting my proxy card?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the stockholder of record of your shares, you may revoke your proxy in any one of three ways:

• You may change your vote using the same method that you first used to vote your shares;

• You may send a written notice that you are revoking your proxy to BM Technologies, Inc., 201 King of Prussia Road, Suite 350,650, Wayne, Pennsylvania, Attention: Robert Ramsey,Ajay Asija, Chief Financial Officer; or

• You may participate in the Annual Meeting and vote virtually. Simply participating in the Annual Meeting, however, will not, by itself, revoke your proxy.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count “FOR” and “WITHHOLD AUTHORITY” votes for Proposal No. 1, and with respect to Proposal No. 2,1, and “FOR,” “AGAINST” and “ABSTAIN.”“ABSTAIN” votes with respect to Proposal No. 2. A broker non-vote occurs when a nominee, such as a brokerage firm, bank, dealer, or other similar organization, holding shares for a beneficial owner, does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner. In the event that a broker, bank, custodian, nominee, or other record holder of our common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a brokerage firm, bank, dealer, or other similar organization, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. We believe that Proposal No. 1 (election of directors) is a non-routine proposal. Since this proposal to be voted on at the Annual Meeting is not a routine matter, the broker or nominee that holds your shares will need to obtain your authorization to vote those shares and will enclose a voting instruction form with this proxy statement. The broker or nominee will vote your shares as you direct on their voting instruction form, so it is important that you include voting instructions.

Abstentions will be treated as shares present for the purpose of determining the presence of a quorum for the transaction of business at the Annual Meeting.Meeting but not as a vote cast on any matter.

4

How many votes are needed to approve each proposal?

The following table describes the voting requirement for each proposal:

Proposal 1 | Election of |

| ||

Proposal 2 | Ratification of the appointment of | This proposal must be approved by a majority of votes cast by the |

How many shares must be present to constitute a quorum for the Annual Meeting?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are represented by stockholders present at the Annual Meeting or by proxy. On April 29, 2022,26, 2024, the record date, there were 12,273,43812,052,560 shares outstanding and entitled to vote. Thus, 6,136,7206,026,281 shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote virtually at the Annual Meeting. Abstentions will be counted towards the quorum requirement.

If a quorum is not present at the Annual Meeting, or if a quorum is present but there are not enough votes to approve one or more of the proposals, the person named as chair of the Annual Meeting may adjourn the meeting to permit further solicitation of proxies. A stockholder vote may be taken on one or more of the proposals in this proxy statement prior to any such adjournment if there are sufficient votes for approval on such proposal(s).

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K that we expect to file with the Securities and Exchange Commission within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

5

How and when may I submit a stockholder proposal for the Company’s 20232025 Annual Meeting?

We will consider for inclusion in our proxy materials for the 20232025 Annual Meeting of Stockholders, stockholder proposals that are received at our executive offices, in writing, no earlier than February 13, 2023 and no later than 5:00 p.m. (Eastern Time) on March 15, 2023,December 30, 2024, and that comply with our bylaws and all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Proposals must be sent to our Corporate Secretary at BM Technologies, Inc., 201 King of Prussia Road, Suite 350,650, Wayne, Pennsylvania 19087.

Pursuant to our bylaws, stockholders wishing to nominate persons for election as directors or to introduce an item of business at an annual meeting that are not to be included in our proxy materials must have given timely notice thereof in writing to our Corporate Secretary. To be timely for the 20232025 Annual Meeting of Stockholders, you must notify our Corporate Secretary, in writing, no earlier than February 13, 2023,20, 2025, and no later than 5:00 p.m. (Eastern Time) on March 15, 2023.22, 2025. We also advise you to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations, including the different notice submission date requirements in the event that the date of the notice for the 20232025 Annual Meeting of Stockholders is more than 30 days before or 60 days after the first anniversary of the date of the 20222024 Annual Meeting. In accordance with our bylaws, our board or chair of the 20232025 Annual Meeting of Stockholders may determine, if the facts warrant, that a matter has not been properly brought before the meeting and, therefore, may not be considered at the meeting.

Pursuant to the Company’s bylaws, among other things, a stockholder’s notice shall set forth information as to the stockholder giving notice, as well as to each individual whom the stockholder proposes to nominate for election or reelection as a director:

• the name, age, business address and residence address of such individual;

• Thethe principal occupation or employment of the individual;

• the class, series and number of any shares of stock of the Company that are owned beneficially ownedor of record by such individual;

• all other information relating to such individual that is required to be disclosed in solicitations of proxies for election of directors in an election contest (even if an election contest is not involved), or is otherwise required, in each case pursuant to Regulation 14ASection 14 under the Exchange Act (including such individual’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected).

Additionally, the stockholder giving notice must include a description of all arrangements and understandings relating to the nomination to be made and a representation that such stockholder or a qualified representative of such stockholder intends to appear in person or by proxy at the meeting to nominate such person or persons named in the notice. All nominees properly submitted to the Company (or which the nominating and corporate governance committee otherwise elects to consider) will be evaluated and considered by the members of the nominating and corporate governance committee using the same criteria as nominees identified by the nominating and corporate governance committee itself.

How can I obtain the Company’s Annual Report on Form 10-K?

A copy of our 20212023 Annual Report on Form 10-K for the fiscal year ended December 31, 20212023 is available at https://ir.bmtxinc.comir.bmtxinc.com. . You also can obtain copies without charge at the SEC’s website at www.sec.govwww.sec.gov. . Our 20212023 Annual Report is not incorporated into this proxy statement and shall not be considered proxy solicitation material.

We will also mail to you without charge, upon written request, a copy of any specifically requested exhibit to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021.2023. Requests should be sent to: Corporate Secretary, BM Technologies, Inc., 201 King of Prussia Road, Suite 350,650, Wayne, Pennsylvania 19087. A copy of our Annual Report on Form 10-K has also been filed with the Securities and Exchange Commission, or the SEC and may be accessed from the SEC’s homepage (www.sec.gov(www.sec.gov)).

6

Who is paying for this proxy solicitation?

The Company will pay for the entire cost of soliciting proxies. The Company may engage a third party-party proxy solicitor. The proxy solicitor may call you and ask you to vote your shares. The proxy solicitor will not attempt to influence how you vote your shares, but only ask that you take the time to cast a vote. You may also be asked if you would like to vote over the telephone and to have your vote transmitted to our proxy tabulation firm.

In addition to these written proxy materials, directors, officers and employees of BM Technologies, Inc. may also solicit proxies in person, by telephone or by other means of communication; however, the directors, officers and employees of BM Technologies, Inc. will not be paid any additional compensation for soliciting proxies. In addition to the solicitation of proxies by the use of thevia mail, proxies may be solicited in person and/or by telephone or facsimile transmission by any proxy solicitor, directors, officers, or employees of BM Technologies, Inc.

The Company may also reimburse brokerage firms, banks, and other agents for the cost of forwarding proxy materials to beneficial owners.

How many copies should I receive if I share an address with another stockholder?

The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies.

Under this procedure, brokers are permitted to deliver a single copy of our Notice and, as applicable, any additional proxy materials that are delivered until such time as one or more of these shareholders notifies their broker that they want to receive separate copies. Once you have received notice from your broker that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If at any time you no longer wish to participate in householding and would prefer to receive a separate proxy statement and Annual Report, or if you are receiving multiple copies of the proxy statement and Annual Report and wish to receive only one, please notify your broker if your shares are held in a brokerage account or us if you are a stockholder of record. You can notify us by sending a written request to: Corporate Secretary, BM Technologies, Inc., 201 King of Prussia Road, Suite 350,650, Wayne, Pennsylvania 19087, or by calling (571) 236(877) 327-8851-9515. In addition, the Company will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the Annual Report and proxy statement to a stockholder at a shared address to which a single copy of the documents was delivered.

Whom should I contact if I have any questions?

If you have any questions about voting your shares or about the Annual Meeting, these proxy materials, or your ownership of our common stock, please contact Robert Ramsey,Ajay Asija, Chief Financial Officer, 201 King of Prussia Road, Suite 350,650, Wayne, Pennsylvania 19087, Telephone: (571) 236(877) 327-8851.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on June 15, 2022: This Proxy Statement and the Annual Report are available on-line at https://ir.bmtxinc.com-9515.

7

PROPOSAL NO. 1

ELECTION OF CLASS II DIRECTORS

The Board of Directors presently has seven members. Our Board of Directors is divided into three classes. Each class has a three-year term. Class I directors hold office for a term expiring at the Annual Meeting of Stockholders to be held in 2024, Class II directors hold office for a term expiring at the Annual Meeting of Stockholders to be held in 20222025 (with the exception of Michael Pavone, who will be nominated at this Annual Meeting for a one-year term until the Class II directors are elected in 2025) and Class III directors hold office for a term expiring at the Annual Meeting of Stockholders to be held in 2023.2026. Each director holds office for the term to which he or she is elected and until his or her successor is duly elected and qualified. Vacancies on the Board of Directors may be filled by persons elected by a majority of the remaining directors and nominated by the nominating and corporate governance committee. A director elected by the Board of Directors to fill a vacancy in a class, including any vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified. Messrs. Aaron Hodari and Pankaj DinodiaJohn Dolan are Class I directors; Ms. Marcy Schwab and Messrs. A.J. DunklauMichael Pavone and Mike Gill are Class II directors; and Ms. Luvleen Sidhu and Mr. Brent Hurley are Class III directors.

|

|

|

|

|

|

| ||||||

|

|

|

| |||||||||

|

|

|

| |||||||||

|

|

|

| |||||||||

|

|

| ||||||||||

|

|

|

|

| ||||||||

|

|

| ||||||||||

|

|

|

|

|

Director/Nominee(1) | Age | Class | Term Expires | Audit Committee | Nominating & Corporate Governance Committee | Compensation Committee | ||||||

John Dolan(2) | 67 | I | 2024 | Chair | ||||||||

Aaron Hodari(2) | 37 | I | 2024 | |||||||||

Michael Pavone(3) | 60 | II | 2025 | P | ||||||||

Marcy Schwab | 52 | II | 2025 | P | ||||||||

Mike Gill | 72 | II | 2025 | P | Chair | |||||||

Luvleen Sidhu | 38 | III | 2023 | |||||||||

Brent Hurley | 45 | III | 2023 | P | Chair |

____________

* Indicates Class II director nominees

(1) This column reflects the current directors and nominees on the Board of Directors. The bolded individuals are the nominees.

(2) Mr. Dolan and Mr. Hodari are nominated as Class I directors for terms to expire at the 2027 Annual Meeting.

(3) Mr. Pavone is nominated as a Class II director for a term to expire at the 2025 Annual Meeting. On July 11, 2023, Mr. Pavone was appointed to fill a vacancy on the Board that resulted from the resignation of director A.J. Dunklau.

The Board of Directors has nominated three directors (upon the recommendation of the nominating and corporate governance committee), Ms. Schwab two directors, Messrs. Dolan and Messrs. Dunklau and Gill,Hodari, for election as Class I directors and one director, Mr. Pavone, for election as a Class II directors.director, following his July 11, 2023 appointment by the Board to fill the vacancy from A.J. Dunklau’s resignation. If elected at the Annual Meeting, each of Ms. SchwabMr. Dolan and Messrs. DunklauMr. Hodari would serve until the 2027 Annual Meeting of Stockholders and Gilluntil his successor is elected and has qualified, or, if sooner, until his or her death, resignation, or removal. Similarly, if elected at the Annual Meeting, Mr. Pavone would serve until the 2025 Annual Meeting of Stockholders and until his successor is elected and has qualified, or, if sooner, until his or her death, resignation, or removal. Neither of Ms. Schwab and Messrs. Dunklau and GillMr. Dolan, Mr. Hodari, nor Mr. Pavone is being nominated as a director for election pursuant to any agreement or understanding between such person and the Company. Each of Ms. SchwabMr. Dolan, Mr. Hodari, and Messrs. Dunklau and Gill hasMr. Pavone have all indicated their willingness to continue to serve if elected and hashave consented to be named as a nominee. It is our policy to encourage directors and nominees for director to attend the Annual Meeting.

The directors will be elected by a plurality of the votes cast at the meeting, which means that the twothree nominees receiving the highest number of votes will be elected. Any shares not voted, whether by withheld authority, broker non-votes, abstention or otherwise, will have no effect on the outcome of the election of directors. There are no cumulative voting rights with respect to the election of directors.

The Board of Directors recommends a vote “FOR” the election of all the nominees whose names are set forth on the following pages. A stockholder can vote for or withhold his or her vote from each nominee. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy for the election of the nominees named below. If a nominee should decline or be unable to serve as a director, it is intended that the proxy will be voted for the election of such person who is nominated as a replacement. The Board of Directors has no reason to believe that the Class I director nominees and the Class II director nomineesnominee named will be unable or unwilling to serve.

8

Information about the Nominees and Directors

Biographical information with respect to the Class III nominees and Class I nominee up for election at the Annual Meeting, as well as each of the other directors, and such person’s qualifications to serve as a director is set forth on the succeeding pages. Unless otherwise indicated, each director has held his or her principal occupation or other positions with the same or predecessor organizations for at least the last five years. There are currently no family relationships among any director, nominee, or executive officer.

8

Nominees for Class III Directors

Name, Address and Age(1) | Position(s) | Term of | Principal | Other | ||||

Independent Director | ||||||||

John Dolan, Age 67 | Director | Class I | Founder and Manager of Dolan Financial Solutions, LLC, a business strategy and financial consulting firm and loan broker. | None. | ||||

Non-independent Director | ||||||||

Aaron Hodari, Age 37(2) | Director | Class I director since January 2021; term expires 2024 | Managing Director of Schechter Private Capital, LLC, an investment management company. | None. |

____________

(1) The address for each of Mr. Dolan and Mr. Hurley is c/o 201 King of Prussia Road, Suite 650, Wayne, Pennsylvania 19087.

(2) Mr. Hodari is not considered an independent director because of his employment with a significant shareholder of the Company.

Independent Director

John Dolan has served as our director since May 2022. Since 2020, Mr. Dolan has served as Founder and Manager of Dolan Financial Solutions, LLC, a business strategy and financial consulting firm and loan broker. From 2015 to 2017, Mr. Dolan was the Founder and Managing Member of Dolan Finance, LLC. Mr. Dolan was Chairman of the Board of Directors of Atlantic Coast Financial Corporation (Nasdaq: ACFC) from 2016 until its acquisition by Ameris Bancorp in 2018. From 2013 to 2018, he also served as Chairman of ACFC’s Audit Committee. From 1980 to 2011, Mr. Dolan was employed by First Commonwealth Financial Corporation (NYSE: FCF) and its predecessor (First Commonwealth) headquartered in Indiana, Pennsylvania. Mr. Dolan most recently served as the President and Chief Executive Officer of First Commonwealth after serving as its Chief Financial Officer for twenty years and was also a director from 2007 to 2011. In these roles, he helped transform First Commonwealth from a bank with $200 million in assets to a NYSE traded bank holding company with $6 billion in assets. Throughout his banking tenure, Mr. Dolan was active in industry groups such as the Financial Services Roundtable, Pennsylvania Bankers Association, and the American Bankers Association. Mr. Dolan is an active angel investor and is experienced in economic development and assisting early-stage companies during their development. He serves on the board of directors of Pratter, Inc., an early-stage company that provides transparency to reduce healthcare costs and has served on several not-for profit boards. Mr. Dolan earned his B.S. in Business Administration with a specialization in accounting from West Liberty University. We believe that Mr. Dolan is qualified to serve as a member of our Board of Directors based on his extensive experience serving banks and financial services companies and experience serving on boards of directors, including on the audit committee, and his substantial industry knowledge.

9

Non-Independent Director

Aaron Hodari has served as our director since January 2021. Mr. Hodari, a CFP and CIMA, is a Managing Director of Schechter Private Capital, LLC. Aaron Hodari heads the firm’s branch of Private Capital, including deal sourcing, due diligence, deal structuring, and market opportunity identification, and investor relations. Aaron also works directly with ultra-high net worth families bringing them institutional quality investment management and advanced financial planning solutions. He is also instrumental in the development of correlated and non-correlated investment alternatives at Schechter, helping identify investment allocations and manager selection. Prior to joining Schechter, Aaron worked at BlackRock Financial Management in the Institutional Account Management group where he managed relationships with institutional investors including pension funds, foundations & endowments, and family offices. While there, he specialized in customized fixed-income solutions, commodities, and hedge funds. Aaron graduated from the University of Michigan, where he majored in economics and played lacrosse. He is a member of the CAIS Advisory Council. We believe that Mr. Hodari is qualified to serve as a member of our Board of Directors based on his financial and investment management expertise.

Nominee for Class II Director

Name, Address and Age(1) | Position(s) | Term of | Principal | Other | ||||

Independent Director | ||||||||

Michael Pavone, Age 60 | Director | Class II director since July 2023; term expires 2025 | Chief Executive Officer of Pavone Group, a marketing and advertising group; President and CEO of Vigor, a niche branding and marketing agency since 2021; President and CEO of Eastwest Marketing Group, a shopper marketing/point of sale design agency, since 2021. | None. |

____________

(1) The address for Mr. Pavone is c/o 201 King of Prussia Road, Suite 650, Wayne, Pennsylvania 19087.

Independent Director

Michael Pavone has served as our director since July 2023. Mr. Pavone has been President and CEO of the Pavone Marketing Group, Inc., a holding company comprised of several marketing, branding, advertising, and analytics companies, including Pavone LLC, quench LLC, Varsity LLC, and WildFig Data LLC, since 1992. Mr. Pavone has served as: President and CEO of Vigor, a niche branding and marketing agency focused on the restaurant and hospitality industries since 2021; President and CEO of Eastwest Marketing Group, a shopper marketing/point of sale design agency, since 2021; CEO of WildFig Data, a data analytics consultancy, since 2015; President and CEO of quench agency, a full-service advertising agency focused on CPG — Food and Beverage brands, since 2014; and CEO of Varsity, a full-service advertising agency focusing on senior living and senior health market, since 2007. Mr. Pavone was a finalist for the Ernst & Young’s Entrepreneur of the Year award and has led several of the companies in the Pavone Group to place on Fastest Growing Companies Lists and to win numerous national and international creative and marketing awards. Mr. Pavone is also a member of the Young Presidents’ Organization. We believe that Mr. Pavone is qualified to serve on the Board based on his digital marketing and innovative branding experience, as well as his extensive industry contacts.

10

Class II Directors (continuing directors not up for re-election at the Annual Meeting)

Name, Address, and Age(1) | Position(s) | Term of | Principal | Other | ||||

Independent Directors | ||||||||

Marcy Schwab, Age 52 | Director | Class II director since | President and Founder of Inspired Leadership, LLC, a consulting, leadership advisory, and executive coaching services firm. | None. | ||||

| Director | Class II director since |

|

| ||||

|

|

| Retired attorney 2016-present. | None. |

____________

(1) The address for each of Ms. Schwab and Messrs. Dunklau andMr. Gill is c/o 201 King of Prussia Road, Suite 350,650, Wayne, Pennsylvania 19087.

Independent Directors

Marcy Schwab has served as our director since our business combination with Megalith Financial Acquisition Corporation that consummated January 4, 2021 (the “Business Combination”).2021. Ms. Schwab is the President of Inspired Leadership, LLC, which she founded in 2012. Inspired Leadership, LLC provides consulting, leadership advisory, and executive coaching services to Fortune 500 companies, start-ups, federal, state and local agencies, and not-for-profits. Ms. Schwab has also served as principal at thought LEADERS,thoughtLEADERS, LLC since 2016, and is a member at Forbes Coaches Counsel.2016. From July 2019 to September 2020, Ms. Schwab served of chief of staff to the CEO of Reserve Trust Company part time and served as Vice President of Retail Banking at Sallie Mae from 2010 to 2012. Ms. Schwab served in various roles at Capital One, including Senior Vice President, Consumer Segment Lending from 2008 to 2009, Vice President of Direct Banking from 2007 to 2008, and Senior Business Director of Internet Card from 1998 to 2007. Ms. Schwab brings over 25 years of experience as a senior executive, consultant, facilitator, and leadership coach. Ms. Schwab earned an MBA from The Wharton School of Business and a Bachelor of Science in Engineering from the University of Pennsylvania. We believe that Ms. Schwab is qualified to serve as a member of our Board of Directors based on her experience as a senior leader at several consumer focused financial services companies.

9

A.J. Dunklau -focusedhas served as our director since the Business Combination and until the Business Combination served as President of Megalith since its inception, and served Chief Executive Officer of Megalith since May 5, 2020. Since January 2021, Mr. Dunklau has served as General Manager of LightBox, a provider of due diligence, risk management, location intelligence and workflow solutions. From 2011 through 2017, Mr. Dunklau was an executive at AGDATA, LP, a provider of payment facilitation, information services, and software, which was sold to Vista Equity Partners in 2014. From 2016 to 2017 Mr. Dunklau served as AGDATA’s Chief Strategy Officer and from 2014 to 2016 he served as its Head of Product Management. From 2012 to 2014, Mr. Dunklau served as AGDATA’s Executive Vice President and General Manager of Industry Platforms, and prior to that served as Director of Business Development. From 2005 to 2011, he worked as a management consultant at A.T. Kearney, where he consulted on global projects across a range of industries, including financial services. Mr. Dunklau received his Bachelors of Science in Business Administration from Washington University in St. Louis and an MBA from the Harvard Business School. We believe that Mr. Dunklau is qualified to serve as a member of our Board of Directors based on his financial and technology experience, and experience advising, developing and growing financial services companies.

Mike Gill has served as our director since the Business Combination.January 2021. Mr. Gill is a retired attorney who worked as Managing Director Global Complex Contracting at Accenture LLP from 2003 to October 2016. At Accenture LLP, Mr. Gill headed up a team of over 160 attorneys worldwide, specializing in technology, digital, outsourcing, and systems integration transactions and helping to negotiate and close large and complex customer-facing contracts across the world, including in the financial services industry. Prior to working at Accenture, Mr. Gill practiced as a transactional attorney for over 25 years in Kansas City, Missouri specializing in professional services providers, including consultants, accountants, architects, and attorneys. Mr. Gill also has experience in commercial litigation, including malpractice and securities law defense. Mr. Gill earned his BS in Business from University of Missouri and his JD from University of Missouri School of Law. We believe that Mr. Gill is qualified to serve as a member of our Board of Directors based on his legal experience, experience within the financial services industry and significant experience structuring and negotiating complex transactions both domestically and globally.

11

Class III Directors (continuing directors not up for re-election at the Annual Meeting)

Name, Address and Age(1) | Position(s) | Term of | Principal | Other | ||||

| ||||||||

Luvleen Sidhu, Age 38(2) | Founder, Chief Executive Officer and Chair | Class III director since January 2021; term expires 2026 | Founder, Chief Executive Officer and President of BankMobile Technologies, Inc. from 2020 to 2021. | None. | ||||

Independent Director | ||||||||

Brent Hurley, Age 45 | Director | Class III director since | Serial |

| ||||

| ||||||||

|

|

|

| None. |

____________

(1) The address for each of Ms. Sidhu and Mr. Hurley is c/o 201 King of Prussia Road, Suite 350,650, Wayne, Pennsylvania 19087.

(2) Ms. Sidhu is not considered an independent director because of her position with the Company.

10

Non-independent DirectorChair

Luvleen Sidhuhas served as BM Technologies’sour Founder, Chief Executive Officer and DirectorChair since 2020January 2021 and was the youngest female Founder and CEO to take a company public at the time of listing when she took BM Technologies public in 2021 (NYSE: BMTX). From 2020 to 2021, she served as Founder, Chief Executive Officer, and President of our predecessor, BankMobile Technologies, Inc. and from February 2014 to present, Ms. Luvleen Sidhu2020, served as Founder, Chief Strategy Officer, and President of the Company and its predecessor, which she helped found.BankMobile. Ms. Luvleen Sidhu earned her MBA from the Wharton School of Business of the University of Pennsylvania and her bachelor’s degree from Harvard University. After graduating from Harvard and Wharton she was a management consultant at Booz & co.Company in their financial services practice. Ms. Luvleen Sidhu is a recognized leader in the industry and was named one of Crain’s New York Business 2020 40 Under 40 and a “Rising Star in Banking & Finance” and “New York Business 2021 Notable Women on Wall Street.” She was included in Innovative Finance’s “Women in FinTech Powerlist 2020,” named one of PaymentsSource’s “Most Influential Women in Payments: Next” in 2021, recognized by Banking Northeast as one of its New York Women in Banking in 2021, and received the honor of FintechFinTech Woman of the Year by Lendit FintechFinTech for 2019 and again in February 2022 — the first ever two-time winner. Before attending business school at Wharton, she was an analyst at Neuberger Berman and also worked as a director of corporate development at Customers Bank. While at the company,Customers Bank, Ms. Luvleen Sidhu introduced several growth projects, including partnering with a New York City-based start-up to improve the banking experience through innovative technology. Ms. Luvleen Sidhu has been featured regularly in the media including on CNBC, Bloomberg Radio, Yahoo Finance, Fox News Radio, and in The Wall Street Journal, Forbes.com, American Banker, Crain’s New York, and FoxNews.com, among others. We believe that Ms. Sidhu is qualified to serve as a member of our Board of Directors based on her extensive experience creating and developing the BMTX (formerly known as BankMobile) platform since our inception and her fintechFinTech experience and insights.

Independent Director

Brent Hurley has served as our director since the Business Combination.January 2021. Since July 2016, Mr. Hurley has been a serial angel investor in various technology start-up companies and participated in multiple venture funds. Mr. Hurley has been a member of MFA Investor Holdings, the sponsor of MFAC,our predecessor Megalith Financial Acquisition Corp., since 2018. From January 2015 to June 2016, Mr. Hurley was Chief Executive Officer and Co-founder of SayMore, a social network start-up company. From November 2011 to January 2015, Mr. Hurley served as Chief Financial Officer of MixBit, Inc. (previously AVOS Systems), a multinational consumer technology company backed by GV (formerly Google Ventures) and NEA. Prior to that, Mr. Hurley was a founding team member of YouTube for four years until its

12

sale to Google, serving as Director of Finance and Operations from 2005 to 2007 and, following the sale to Google, Manager on the YouTube Strategic Partnerships Team. Prior to that, Mr. Hurley was a buyside securities trader and portfolio accountant at Fisher Investments. Mr. Hurley began his career as an intern at PayPal, Inc. when it had less than 25 employees. Mr. Hurley served on the board of directors of MixBit, a private company, from 2014 to 2018, and has served two 3-year terms on the Board of Trustees at Albright College and one term on the Harvard Business School Alumni Board. Mr. Hurley earned his BS in Finance & Philosophy from Albright College and his MBA from Harvard Business School. We believe that Mr. Hurley is qualified to serve as a member of our Board of Directors based on his extensive experience investing in and developing technology start-up companies and his finance and accounting experience.

Class I Directors (continuing directorsIdentifying and Evaluating Director Nominees

The Board and Nomination and Governance Committee consider many methods for identifying and evaluating potential director nominees. Our Board has not upestablished minimum qualifications for re-election atpotential director nominees. The Nomination and Governance Committee instead recommends director nominees based on the Annual Meeting

|

|

|

|

| ||||

| ||||||||

|

|

|

|

|

11

|

|

|

|

| ||||

| ||||||||

|

|

|

|

|

____________

(1) The address for each of Messrs. Hodari and Dinodia is c/o 201 King of Prussia Road, Suite 350, Wayne, Pennsylvania 19087.

(2) Mr. Hodari is not considered an independent director because of his employment with a significant shareholderneeds of the Company.

Independent Director

Pankaj Dinodia has served as our director since the Business Combination. Since June 2011, Mr. Dinodia has been Chief Executive OfficerCompany and founder of Dinodia Capital Advisors, a SEBI-registered financial advisory services firm based in New Delhi, which provides strategic and merger and acquisitions services and works closely with several family offices on global investments and asset allocation. Prior to that, Mr. Dinodia earned his MBA from the Harvard Business School. From July 2008 to July 2009, Mr. Dinodia worked for accounting firm S.R. Dinodia & Co., developing its M&A Advisory practice. From July 2007 to July 2008, Mr. Dinodia helped establish and run Goldman Sachs’ private equity business in India. Prior to that, Mr. Dinodia had served within the Investment Banking Division at Goldman Sachs in New York City since 2005, where he provided mergers and acquisition and investment advisory services to global banks, insurance and fintech companies. He has previously servedcircumstances such as the Founder & PresidentBoard’s size, committee composition, and anticipated vacancies and factors including, without limitation, the candidate’s experience, background, qualifications, technical expertise, skill set, previous or concurrent board service, professional ethics and integrity, judgment, and diversity. While the Nomination and Governance Committee does not have a formal diversity policy, it seeks to create a well-balanced Board that combines broad business and industry experience with diverse backgrounds and unique perspectives. The Nomination and Governance Committee also considers whether the candidate would be considered independent under the rules of the Wharton Alumni Delhi Chapter as well as on the Executive Board for the Harvard Business School Club of India. Mr. Dinodia graduated magna cum laude at the Wharton School, earning his BS Economics degree with a concentration in finance. He also earned his MBA at the Harvard Business School. We believe that Mr. Dinodia is qualified to serve as a member ofSEC, NYSE American, and our Board of Directors based on his experience in banking, investing and providing strategic advice and mergers and acquisitions advisory services, as well has his experience mentoring start-ups across industries, including those in fintech and consumer industries.

Non-independent Director

Aaron Hodari has served as our director since the Business Combination. Mr. Hodari, a CFP and CIMA, is a Managing Director of Schechter Private Capital, LLC. Aaron Hodari heads the firm’s branch of Private Capital, including deal sourcing, due diligence, deal structuring, and market opportunity identification, and investor relations. Aaron also works directly with ultra-high net worth families bring them institutional quality investment management and advanced financial planning solutions. He is also instrumental in the development of correlated and non-correlated investment alternatives at Schechter, helping identify investment allocations and manager selection. Prior to joining Schechter, Aaron worked at BlackRock Financial Management, New York, NY in the Institutional Account Management group where he managed relationships with institutional investors including pension funds, foundations & endowments, and family offices. While there, he specialized in customized fixed-income solutions, commodities, and hedge funds. Aaron graduated from the University of Michigan, where he majored in economics and played lacrosse. He is a member of the CAIS Advisory Council. We believe that Mr. Hodari is qualified to serve as a member of our Board of Directors based on his financial and investment management expertise.Corporate Governance Guidelines.

1213

Our Board has adopted Corporate Governance Guidelines that address items such as the qualifications and responsibilities of its directors and director candidates and corporate governance policies and standards applicable. In addition, our Board has adopted a Code of Business Conduct and Ethics that applies to all our employees, officers, and directors, including our Chief Executive Officer, Chief Financial Officer and other executive and senior financial officers. The full text of our Corporate Governance Guidelines and our Code of Business Conduct and Ethics are posted on the Corporate Governance portion of the Company’s website.website at https://ir.bmtxinc.com/governance/governance-documents/. We will post amendments to our Code of Business Conduct and Ethics or waivers of our Code of Business Conduct and Ethics for directors and officers on the same website.

Board Composition

Our business affairs are managed under the direction of our Board. Our Board consists of seven members, at least a majority of whom qualify as independent within the meaning of the independent director guidelines of the NYSE American. Ms. Luvleen Sidhu and Mr. Hodari are not considered independent.

Our Board is divided into three staggered classes of directors. At each annual meeting of our stockholders, a class of directors will be elected for a three-year term, to succeed the same class whose term is then expiring (with the exception of Michael Pavone, who will be elected for a one-year term until the Class II directors are elected in 2025), as follows:

• the Class I directors are Aaron Hodari and Pankaj Dinodia,John Dolan, and their terms will expire at the annual meeting of stockholders to be held in 2024;

• the Class II directors are A.J. Dunklau,Michael Pavone, Marcy Schwab, and Mike Gill,Gill. Mr. Pavone’s term will expire at the annual meeting of stockholders to be held in 2024 and theirMs. Schwab and Mr. Gill’s terms will expire at the annual meeting of stockholders to be held in 2022;2025; and

• the Class III directors are Luvleen Sidhu and Brent Hurley, and their terms will expire at the annual meeting of stockholders to be held in 2023.2026.

Our Charter provides that the CompanyCompany’s Board will consist of one or more members, and the number of directors may be increased or decreased from time to time by a resolution of the Company Board. Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation, or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the total number of directors. This classification of the Company Board may have the effect of delaying or preventing changes in control of the Company.

Each of the Company’s officers serveserves at the discretion of the Company Board and will hold office until his or her successor is duly appointed and qualified or until his or her earlier resignation or removal. There are no family relationships among any of the directors or officers of the Company. The Company Board has combined the CEO and Chair of Board positions and has appointed Pankaj DinodiaMike Gill as lead independent director to help management coordinate with the independent directors.

Director Independence

The Company’s Common Stock is listed on the NYSE American. Under the NYSE American rules, independent directors must comprise a majority of a listed company’s board of directors. In addition, the NYSE American rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent. Under the NYSE American rules, a director will only qualify as an “independent director” if that director is not an executive officer or employee of the company and, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Audit committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Exchange Act and the rules of the NYSE.NYSE American. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and the NYSE American rules.

14

In order to be considered independent for purposes of Rule 10A-3 under the Exchange Act and under the rules of the NYSE American, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the committee, the board of directors, or any other board committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries.

13

To be considered independent for purposes of Rule 10C-1 under the Exchange Act and under the rules of the NYSE American, the board of directors must affirmatively determine that the member of the compensation committee is independent, including a consideration of all factors specifically relevant to determining whether the director has a relationship to the company which is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to: (i) the source of compensation of such director, including any consulting, advisory or other compensatory fee paid by the company to such director; and (ii) whether such director is affiliated with the company, a subsidiary of the company or an affiliate of a subsidiary of the company.

OurApplying these standards and criteria, our Board has undertakenperiodically reviews our directors’ independence, taking into account all relevant facts and circumstances. Every year, each Board member answers a questionnaire designed to disclose conflicts and related party transactions. For its most recent review, of the independence of each directorBoard reviewed the questionnaires and considered, among other things, whether each director of the Company has a material relationship with the Company that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities.

As a result of this review, wethe Board determined that Pankaj Dinodia, Mike Gill, Brent Hurley, A.J. Dunklau,each of our current directors, other than Luvleen Sidhu and Marcy SchwabAaron Hodari, will be considered an “independent directors”director” as defined under our director independence standards, the listing requirements and rules of the NYSE American and the applicable rules of the Exchange Act.Act as currently in effect. Luvleen Sidhu does not satisfy these independence standards because she is employed as by us as our CEO in addition to her role as a director. Aaron Hodari does not satisfy these independence standards due to his employment by Schechter Private Capital, a significant shareholder.

Board Leadership Structure

We believe that the structure of our Board and its committees will provide strong overall management of the Company.

Board Committees of the Company Boardand Composition

The Company Board has an audit committee, compensation committee and nominating and corporate governance committee. The composition and responsibilities of each of the committees of the Board of Directors is described below. Members serve on these committees until their resignation or until as otherwise determined by the Company Board.

Audit Committee

Each of theThe members of the Company’s audit committee satisfiesare John Dolan (Chair), Brent Hurley and Marcy Schwab. All members of this committee satisfy the requirements for independence and financial literacy under the applicable rules and regulations of the SEC and rules of the NYSE.NYSE American. The Company also determinesdetermined that Mr. DunklauDolan qualifies as an “audit committee financial expert” as defined in the SEC rules and satisfies the financial sophistication requirements of the NYSE.NYSE American. The Company’s audit committee met six times during the 2023 fiscal year and is responsible for, among other things:

• selecting a qualified firm to serve as the independent registered public accounting firm to audit the Company’s financial statements;

• helping to ensure the independence and performance of the independent registered public accounting firm;

• discussing the scope and results of the audit with the independent registered public accounting firm and reviewing, with management and the independent registered public accounting firm, the Company’s interim and year-end financial statements;

15

• developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

• reviewing the Company’s policies on and oversees risk assessment and risk management, including enterprise risk management;

• reviewing related person transactions and policies;

• reviewing the adequacy and effectiveness of internal control policies and procedures and the Company’s disclosure controls and procedures; and

• approving or, as required, pre-approving, all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm.

The Company Board has adopted a written charter for the audit committee, which is available on the Company’s website.website at https://ir.bmtxinc.com/governance/governance-documents/.

14

Compensation Committee

Each of theThe members of the Company’s compensation committee meetare Mike Gill (Chair) and Michael Pavone. All members of this committee satisfy the requirements for independence under the applicable rules and regulations of the SEC and rules of the NYSE.NYSE American. The Company’s compensation committee met seven times during the 2023 fiscal year and is responsible for, among other things:

• reviewing, approving and determining the compensation of the Company’s officers and key employees;

• reviewing, approving and determining compensation and benefits, including equity awards, to directors for service on the Company Board or any committee thereof;

• administering the Company’s equity compensation plans;

• reviewing, approving and making recommendations to the Company Board regarding incentive compensation and equity compensation plans; and

• establishing and reviewing general policies relating to compensation and benefits of the Company’s employees.

The Company Board has adopted a written charter for the compensation committee, which is available on the Company’s website.website at https://ir.bmtxinc.com/governance/governance-documents/.

Nominating and Corporate Governance Committee

EachThe members of the members of theCompany’s nominating and corporate governance committee meetare Brent Hurley (Chair) and Mike Gill. All members of this committee satisfy the requirements for independence under the applicable rules and regulations of the SEC and rules of the NYSE.NYSE American. The nominating and corporate governance committee met one time during fiscal year 2023 and is responsible for, among other things:

• identifying, evaluating, and selecting, or making recommendations to the Company Board regarding, nominees for election to our Board and its committees;

• evaluating the performance of our Board and of individual directors;

• considering, and making recommendations to the Company Board regarding, the composition of our Board, and its committees;

• reviewing developments in corporate governance practices;

• evaluating the adequacy of the corporate governance practices and reporting;

• reviewing related person transactions; and

• developing, and making recommendations to the Company Board regarding corporate governance guidelines and matters.

16

Our Board has adopted a written charter for the nominating and corporate governance committee, which is available on our website.website at https://ir.bmtxinc.com/governance/governance-documents/.

Code of Conduct and Ethics

We have posted our Code of Conduct and Ethics and expect to post any amendments to or any waivers from a provision of our Code of Conduct and Ethics on our website, and also intend to disclose any amendments to or waivers of certain provisions of our Code of Conduct and Ethics in a Form 8-K.website.

Compensation Committee Interlocks and Insider Participation

None of the Company’s officers currently serves, and in the past year has not served, (i) as a member of the compensation committee or the board of directors of another entity, one of whose officers served on the Company’s compensation committee, or (ii) as a member of the compensation committee of another entity, one of whose officers served on the Company Board.

15

Related Person Policy of the Company

The Company has adopted a formal written policy providing that the Company’s officers, directors, nominees for election as directors, beneficial owners of more than 5% of any class of the Company’s capital stock, any member of the immediate family of any of the foregoing persons, and any firm, corporation or other entity in which any of the foregoing persons is employed or is a general partner or principal or in a similar position or in which such person has a 5% or greater beneficial ownership interest, are not permitted to enter into a related party transaction with the Company without the approval of the Company’s nominating and corporate governance committee, subject to the exceptions described below.

A related person transaction is a transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which the Company and any related person are, were, or will be participants in which the amount involves exceeds the lesser of $120,000 or 1% of our average total assets.assets at year-end for the last two completed fiscal years. Transactions involving compensation for services provided to the Company as an employee or director are not covered by this policy.

Under the policy, the Company will collect information that the Company deems reasonably necessary from each director, executive officer and, to the extent feasible, significant stockholder, to enable the Company to identify any existing or potential related-person transactions and to effectuate the terms of the policy. In addition, under the Code of Conduct, employees and directors have an affirmative responsibility to disclose any transaction or relationship that reasonably could be expected to give rise to a conflict of interest.

The policy will require that, in determining whether to approve, ratify, or reject a related person transaction, our nominating and corporate governance committee, or other independent body of our Board, must consider, in light of known circumstances, whether the transaction is in, or is not inconsistent with, the Company’s best interests and those of our stockholders, as our nominating and corporate governance committee, or other independent body of our Board, determines in the good faith exercise of its discretion.

Our nominating and corporate governance committee has determined that certain transactions will not require the approval of the nominating and corporate governance committee, including certain employment arrangements of officers, director compensation, transactions with another company at which a related party’s only relationship is as a director, non-executive employee or beneficial owner of less than 10% of that company’s outstanding capital stock, transactions where a related party’s interest arises solely from the ownership of our Common Stock and all holders of our Common Stock received the same benefit on a pro rata basis and transactions available to all employees generally.

Communications with Directors

Stockholders and interest parties may communicate with our Committee Chairs and with our non-employee directors by writing to such person or group and directing mail to our Corporate Secretary at BM Technologies, Inc., 201 King of Prussia Road, Suite 650, Wayne, Pennsylvania 19087. The Corporate Secretary will review all such communications and determine whether communications require immediate attention. As appropriate, the Corporate Secretary will forward communications, or a summary of communications, to the appropriate director or directors.

17

Insider Trading Policy (including Hedging and Pledging Policies)

The Company has adopted an Insider Trading Policy, which provides guidelines with respect to transactions in the securities of the Company and the handling of confidential information about the Company and the companies with which the Company does business. The Board has adopted this policy to promote compliance with federal, state and foreign securities laws that prohibit certain persons who are aware of material nonpublic information about a company from: (i) trading in securities of that company; or (ii) providing material information to other persons who may trade on the basis of that information. This policy applies to all officers of the Company and its subsidiaries, all Board members, and all employees of the Company and its subsidiaries, along with certain contractors and consultants and certain family and household members of persons covered by the policy.